- Intuit mint delete account how to#

- Intuit mint delete account manual#

- Intuit mint delete account full#

- Intuit mint delete account for android#

- Intuit mint delete account free#

One drawback of Mint is that it does not provide full customization of categories.

Intuit mint delete account manual#

Even if the payee for your bill isn’t in the Mint universe, you can add it as a manual account. But you can also add other bills, like your cell phone bill or your monthly water bill. Accounts you have linked, like credit cards, will automatically appear in the bills section, indicating the minimum payment due, the last statement balance, and the current balance. In addition to tracking account balances and transactions, Mint can also monitor your bills for you. Then it’s just a matter of following that plan, rather than spending mindlessly.īoth Mint and YNAB provide register views of individual accounts as well as an overall transaction log of all your accounts, the ability to establish savings goals, and a reporting area that allows you to slice and dice your financial data into different analytical views. Rather than simply see what you have spent, YNAB requires you to allocate your income to expenses you prioritize. YNAB refers to its strategy as “giving every dollar a job,” meaning you make a decision before the month begins on what you will do with every dollar you take in. In contrast, creating a budget is not optional with YNAB-instead, it’s the cornerstone of the entire platform and the YNAB way of thinking. Alternatively, you can simply observe how your spending this month compares to last month, or this month a year ago. This then enables you to, optionally, set budget amounts for this month by each of your spending categories. With this information, Mint can then show you reports of how much you spent in each category over various time periods. From there, you can categorize each transaction by its spending or income category. With both apps, you link all of your bank and credit card accounts to the platform in order to capture every transaction. But while Mint takes a very familiar approach, YNAB introduces a much more forward-thinking strategy that is quite a bit different not just in its implementation, but also in the user’s whole way of thinking.

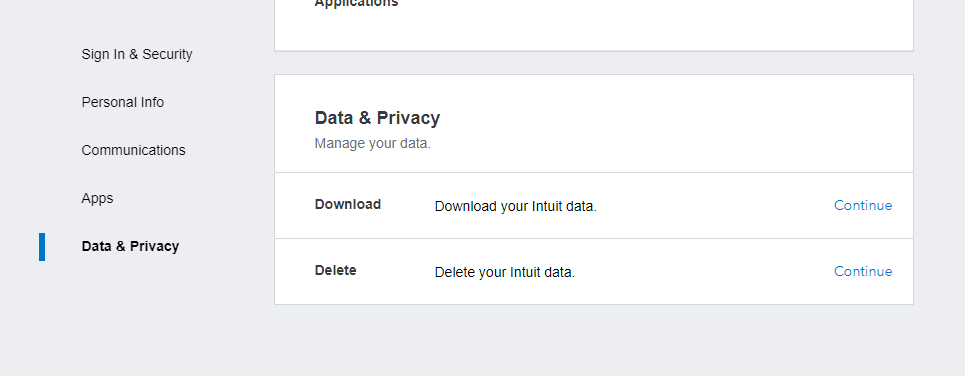

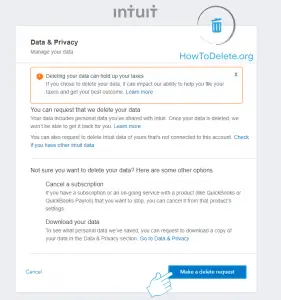

Intuit mint delete account how to#

Those who want to categorize their spending, create this month’s budget, and see an overview of all of their financial accounts in one placeĪt the most basic level, these two personal finance tools do the same thing, which is to help you understand where you spend, and how much, so that you can better decide how to allocate your resources in the future. Those wanting to take a very hands-on approach to forward-thinking budgeting, including adopting a new way of thinking about “giving every dollar a job”

Intuit mint delete account for android#

IOS, Android, web browser, Alexa, Google Assistant (only for Android users)įree trial period, then $14.99/month or $98.99/year, with money-back guarantee IOS, Android, web browser, Apple watches, Alexa With its more hands-off approach, Mint is very easy to set up by simply adding all of your financial accounts

Intuit mint delete account free#

Provides access to a free copy of your credit scoreĪdding your accounts is easy, but getting acclimated to the YNAB budgeting philosophy and process involves a learning curve Reports in multiple categories including spending, income, net worthĪllows you to plan as far into future months as you’d like Reports in three categories: spending, net worth, income vs.

Mint enables you to regularly review all of your financial accounts, including enabling you to see exactly where you’re spending your money YNAB helps you proactively manage your money by prompting you to allocate every dollar of your income to expected expenses or savings for that month To make it easy for you to decide which platform is best for your needs, we carefully researched the features, ease of setup and use, compatibility, pricing, and more to lay out a head-to-head comparison of these two popular tools. Meanwhile, those who simply want to track where they’ve spent their money, as well as see a real-time snapshot of their total net worth in one place, might prefer Mint’s more straightforward approach. But as you’ll see, there are important differences in these two tools, including very different budgeting philosophies and pricing models.įor anyone feeling motivated to develop a strong new strategy to help them achieve financial goals such as getting out of debt, spending less, or simply saving more, YNAB offers not just an app, but a whole new way of thinking about what you can do with each dollar you earn.

Both help consumers track all their expenses, categorize them by expense type, assess how much is going where, and decide allocations for the future. Two of the biggest players in the world of budgeting apps are Mint and YNAB, which stands for You Need A Budget. Read our advertiser disclosure for more info. We may receive compensation if you visit partners we recommend. We recommend the best products through an independent review process, and advertisers do not influence our picks.

0 kommentar(er)

0 kommentar(er)